Working for yourself can be a liberating and empowering experience, but it’s not without its unique challenges either. Learning a valuable skill, such as working as an electrician, is the first step on a self-employment journey that could give you everything you dreamed of. So, if you’re wondering how to get started as an electrician going it on your own, this is a great place to begin.

Firstly, if you’re thinking about becoming a self-employed electrician, once you have completed your training, we would always recommend working with an experienced electrician. This will allow you to gain confidence and experience before going it alone. You can do this by working as an electrician’s mate, working for an electrical contracting firm, or you may have completed an apprenticeship.

Once you feel confident that you have gained enough experience and are competent to go it alone, you may now be ready to take the next step.

Things to consider before going self-employed

Going self-employed effectively means that you are setting up a business. However, before you go much further there are certain things you will want to consider, which include:

- How will I acquire new customers?

- How would I cope during quiet periods of no or little income?

- Do I have enough money to get set up? ie. buying new tools and a van/car

- Can I get by without having the benefits of paid holiday, sick pay and pensions contributions?

- Am I OK working on my own?

- Can I manage my cashflow, record keeping and completing tax returns?

- What insurances do I need?

- Do I need to join a competent person scheme?

What are the advantages of being self-employed?

There are plenty of advantages to being self-employed and these include:

- Being your own boss – you get to have a more varied workload as you get to choose the type of work you take on.

- Being able to work with more flexibility – you will have more control over the hours you work, which will allow you to arrange your day around any other commitments you may have.

- Being able to achieve a much higher income – if you put in the hard work you will be able to earn more. This is mainly because you can charge hourly or day rates, which can be higher than some standard salaries. Day rates can vary depending on your experience and region but range from approx. £140 – £350 per day.

- Offset your tax liability – there are certain costs that you are able to deduct from income when calculating your tax liability, eg. your equipment/tools, mileage, stationery, etc. To find out more click here.

What are the disadvantages of being self-employed?

Of course there will always be some disadvantages to going self-employed and these include:

- Start up costs – you will need to have in place some money to get you started as you will most likely need to buy new tools, a van/car, insurances etc.

- Finding customers – this can be challenging to start, and you will need to find ways to advertise your services to get noticed!

- Income – your income will no longer be consistent. You will need to ensure you can keep up with any bills, loans, mortgages, rents etc. You will also need to bear in mind that during times when you are off work, due to sickness or holiday, you won’t be getting paid.

- Admin – when you work for yourself you will be responsible for the admin side of your business, ie, scheduling in work, quoting, invoicing, insurance, etc. You will have to ensure that you are complying with regulations.

Sole Trader or Limited Company?

Once you have decided to go self-employed your next choice is whether to start up as sole trader or a limited company.

Sole Trader: An advantage to becoming a sole trader is that it is relatively easy to set up. There are also certain expenses you can subtract from your income when calculating your taxable profit, you can check the government website for more detail, but these include business related travel, business insurances, stock, etc.

Disadvantages are that it could be hard to raise finance as lenders tend to prefer to lend to limited companies. The tax rates aren’t always great especially when you reach a certain level of earning. Another thing to consider is that as a sole trader you are the sole owner of the business and as such have unlimited liability. This means that if your business finds itself in debt then you are personally liable and if things go wrong you could end up losing personal assets.

As a sole trader there are certain things you will need to do:

- Firstly set up as a sole trader, you can do this via the GOV.UK website

- Inform HMRC that you are now self-employed as you will now need to pay tax through self-assessment and pay Class 2 and 4 National Insurance contributions. For more info visit the Government’s website.

- Arrange your insurances – these could include professional indemnity insurance and public liability insurance. If you employ anyone you will also need to consider employers liability insurance.

- Check whether you need to set up a business bank account. You may be able to use your personal account, however having a separate account will help to keep your business and personal finances separate.

- Put in place a process for recording your profits and evidence of your business expenses – this will help when completing your tax return.

- If you intend to work from home make sure you check your mortgage or tenancy agreement to ensure you’re not contravening any terms and conditions.

- Consider taking out a private pension to ensure you have money put aside for retirement. The government will still contribute into your pension in the form of tax relief.

Limited Company: To set up a limited company you must register with Companies House. This is known as ‘incorporation’. A limited company has its own legal identity and as such is separate from its owners and directors. A limited company has the benefit of having limited liability, meaning that if something did go wrong your personal assets aren’t exposed.

Limited companies are also more tax efficient as you pay corporation tax on any profits rather than you paying income tax. You can also claim tax relief on business expenses. There are more allowances and tax deductible costs that can be claimed against as a limited company.

The disadvantages of a limited company are that there is a lot more paperwork and legal fees to consider. These include filing a yearly annual return and annual accounts, which you can either do yourself, or hire an accountant to do them for you.

As a limited company there are certain things you will need to do if you’re changing from sole trader:

- Decide if you are going to be the only director or whether you want others involved

- Decide on a name for your company

- Register your business with Companies House – you will need to create your memorandum and articles of association

- Inform HMRC that your legal structure has changed – this is important as this affects the amount of tax you need to pay

- Set up a new business bank account specifically for your limited company

- Let your insurer know that your legal structure has changed

We would recommend that before you make any decision regarding which route to take, you first speak to a financial adviser or accountant to get some sound tax advice.

How Can I Stand Out As A Self-Employed Electrician?

Think of your current skillset: beyond what you have learned about being an electrician, what are some other skills you have learned that could contribute? Do you also know the basics of installing gas, for example, or perhaps you’ve had some experience in marketing or even enjoy creating adverts for your business?

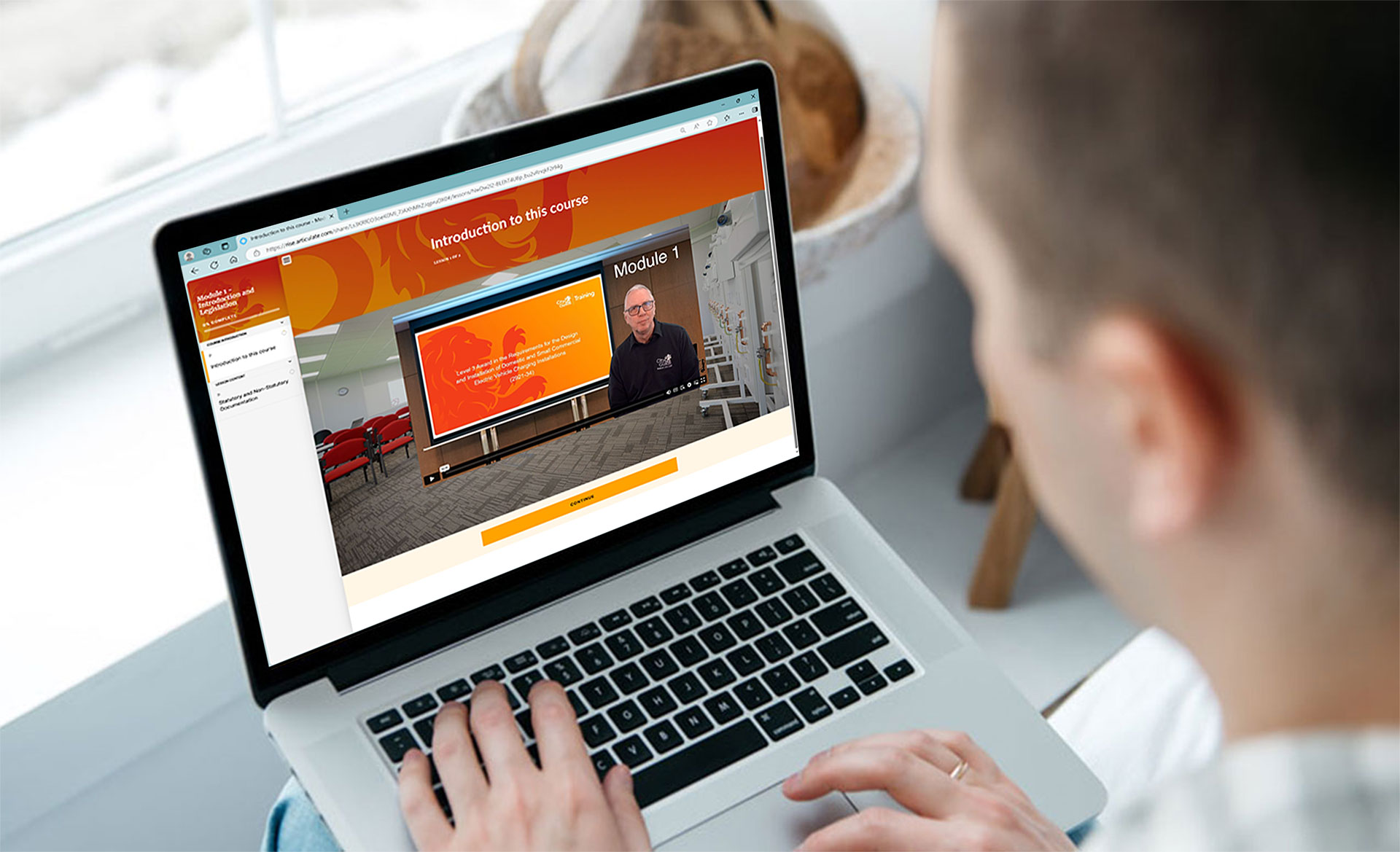

Upskill yourself even more: you will always have an edge over other electricians if there is something that you know that others don’t. For example, with renewable energy on the rise, the inevitable future is more and more solar-powered. If you are able to take some time and learn about the intricacies of solar installation, new solar technology and how to be more eco-conscious, this can go a long way in customers choosing your services.

Be consistent: people are always going to remember exceptional service, whether good or bad. By sticking to your word, showing up, delivering on your promises, and providing a personalised service you will be recommended by customers and build up a loyal base in no time.